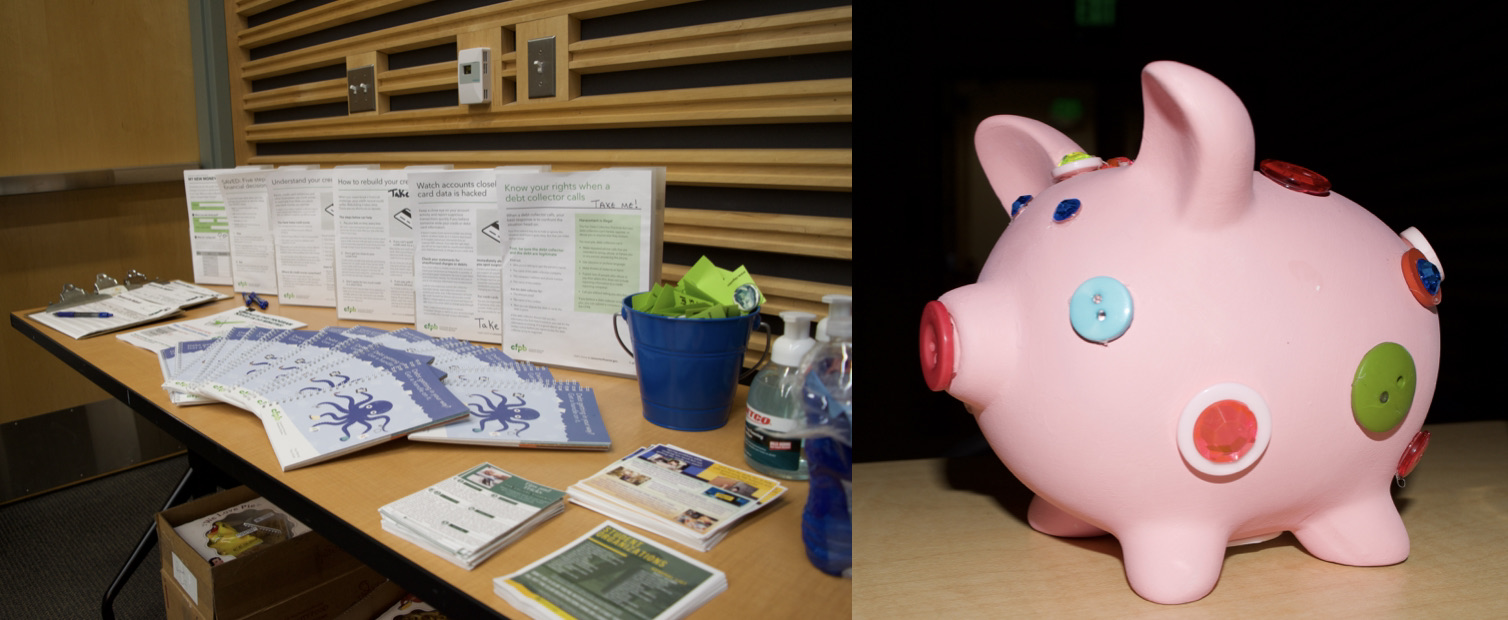

Event table with savings and financial literature (left) and handcrafted piggy bank in the Great Lakes Regional Training Center, Nov. 17. James Cason | The Washtenaw Voice

Ways for college students to save money and get ahead

by JAMES CASON

Deputy Editor

The Office of Student Activities presented a financial freedom workshop held in the Great Lakes Regional Training Center at 11:30 a.m., Nov 17. Speakers from various college departments discussed student loans, transfer scholarships, stackable programs, and extreme couponing for the digital age.

“We decided to do this event because we believe that financial literacy is a critical part to being an educated citizen,” said Devin Struer, WCC international student adviser. “Here at Washtenaw Community College, we feel that we have a lot of ways that we can assist you with mitigating your debt, but also maybe graduating with zero debt.”

Stackable programs

One way to reach financial freedom is stackable programs, which allow students to pursue college certificates and credentials to start working promptly. Then, as students take additional classes in their desired field, they have field-related jobs and continue pursuing higher education in the same industry.

“It’s a great way to save money because you’re only taking a few classes that allow you to start working,” said Struer. “Once you start working, you can start saving more money to pay off the remainder of your classes, hopefully.”

Struer offered an example of a stackable program in the health field: earning a two-semester certificate in sterile processing, which involves the cleaning of medical equipment, and gaining employment at an hourly rate of $18-20 dollars; this same individual could then continue a career path by entering the surgical technologist associate degree program, becoming one who prepares hospital operating rooms.

Transfer Scholarships

Many institutions offer transfer scholarships for students hoping to transfer to a four-year university, which generally requires at least 30 transferrable credits and a 3.0 cumulative GPA.

“Typically, the higher your GPA is, the more scholarship money that you will receive,” said Kelley Holcomb, WCC transfer coordinator. “So, even if you are thinking, ‘oh, a grade doesn’t transfer to my four-year university,’ it definitely helps to do as best as you can in your courses for scholarship eligibility.”

A few mentioned scholarships included the Phi Theta Kappa organization and the Jack Kent Cooke Undergraduate Transfer Scholarship. Five students from WCC have received the Jack Kent Cooke scholarship, which is awarded to top community college students across the country with a 3.5 GPA or higher who have demonstrated financial need.

“If you think you would be eligible to be considered for the scholarship, definitely reach out to our advisor Alexi McCracken for help with the application process. The deadline is Jan 10,” said Holcomb.

Educational Loans

Kristen Hooper, a financial aid coordinator at WCC, presented information about student loans. She stressed several points about these types of loans:

- They must be repaid – no matter what

- There are annual and lifetime limits (for independent and dependent students)

- Crunch your numbers, know what you’re taking and the interest you’re accruing

- Reduce loan amounts by finding scholarships, work-study programs, and institutional aid

- If you take a full-time award, try to be a full-time student

- Use the Federal Student Aid Loan Simulator to estimate monthly repayment plans

“The more education you have, the more likely you are to be able to earn higher wages, live a comfortable life, and be able to repay those student loans you may have taken,” said Hooper.

Extreme couponing for the digital age

Another suggested way of becoming “financially fit” is to use money-saving apps. Those mentioned and recommended for downloading are:

- Ibotta

- Fetch Rewards

- Achievement (exercise-based points)

- Rakuten

Rachel Barsch, WCC student activities supervisor, has been using the Ibotta app for eight years.

“I was a little leery at first about money-saving apps, but I’ve saved an average of $220.75 a year using this app,” said Barsch.

Melinda Harrison, WCC math/science/engineering secretary, attended the event to share information with her sons about money management. She also recently adopted a younger daughter and wants to be proactive by helping her prepare for college expenses with the hope of scholarships. Learning about the loan and savings information was most helpful for Harrison.

“When you write the numbers down, it looks totally different,” said Harrison. “You can say it, but when you start writing it down and plugging in those numbers – that’s when it clicks with me.”