Thousands of Americans were given a stimulus of $1,400 for support during the COVID-19 pandemic

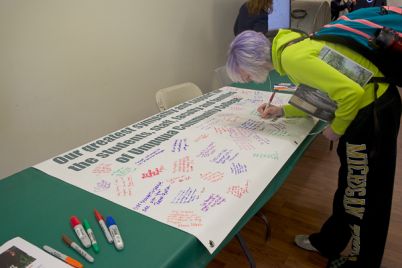

Torrence Williams | Washtenaw Voice

by DAVID CATALAN

Contributor

Two months after President Biden signed a stimulus bill to boost the pandemic-stricken economy, Americans have been receiving their direct payments.

The American Rescue Plan Act, which became law on March 11, directs up to $1,400 to eligible Americans. The law adds additional payments for those who claim dependents and expands the Child Tax Credit.

“It was definitely beneficial to have the stimulus money,” said Mikayla Baker, a business major about to start her final semester. “It helped pay my rent,” she said. She added that the extra cash eased her worries about working during the semester while also paying tuition.

Eligibility for the Economic Impact Payments is based on adjusted gross income, with the full $1,400 going to individuals who earn up to $75,000, and to heads of household who earn up to $112,500. A $2,800 payment goes to joint tax filers who make up to $150,000. Beyond these income limits, the payments phase out, stopping at $80,000 for individuals, and $160,000 for joint filers. Payments to heads of household phase out completely at $120,000.

The direct payments have gone out in waves, a process that is still ongoing. “Payments are automatic for most people,” the IRS said in a press release. But those who haven’t received stimulus funds should “file a 2020 tax return to get all the benefits they’re entitled to under the law.”

Baker had to do just that. She said she didn’t receive a payment at first. But then she filed her taxes. “Shortly thereafter I received some of the back pay for it,” she added.

At a cost of $1.9 trillion, the law is the latest in a series of stimulus packages that were passed by Congress to alleviate the economic toll of the COVID-19 pandemic and boost funding for healthcare services. The law funds a vast set of initiatives, including COVID testing, rental assistance, small business loans, and aid for local governments.

But at the individual level, many Americans will see their wallets impacted by the stimulus in other ways, beyond the direct payments. The law temporarily expands SNAP benefits by 15%, according to a fact sheet published by the White House. And unemployment insurance will continue to pay out the supplemental $300 per week.

Those who are eligible for a direct payment but have not received one can find the status of their payment on the Get My Payment application available on the IRS website.