By Nicholas Ketchum

Deputy Editor

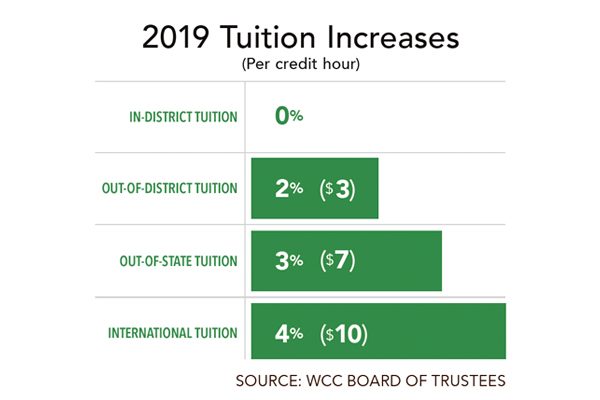

The board of trustees voted unanimously on March 26 to hold in-district tuition rates flat at $95 per credit hour on-campus and $108 per credit hour online for a second consecutive year.

A WCC press release characterized the decision as a “tuition freeze.”

Small increases will be applied to out-of-district, out-of-state and international students. The largest increase will be levied on international students at four percent, which matches overall inflation.

William Johnson, vice president of administration and finance, cites a strong regional economy and correlated strength in property values that allows flat tuition.

“We have a nice, strong base that’s growing robustly with the growth in the economy, so that’s really helped us a lot, in terms of the property tax revenue the college receives through our millages,” said Johnson.

According to the college, WCC is the second-most affordable community college in the state.

Nationally, the college’s affordability ranks well, compared to other community colleges.

According to the American Association of Community Colleges, WCC’s in-district tuition is 38 percent less than average, coming in at $2,280 at WCC vs. $3,660 at an average community college, annually.

Johnson credits steady enrollment trends and eager community support for helping keep tuition relatively low.

“We’ve had steady enrollment. And if you look at the enrollment trends for community colleges in the State of Michigan, we are one of the stronger community colleges, which means that our residents from the area put a stronger value in education and they think that our programs meet their needs,” said Johnson.

Johnson says the college doesn’t predict budget cuts, deferments or other mitigations will be necessary in order to hold in-district tuition flat this year.

“We’re actually forecasting growth; it’s going to be right in line with inflation,” Johnson said. “We are not forecasting we need to reduce budgets in order to help fund a tuition rate freeze for in-district students.”

Johnson said that while risks are always present, planners at the college take precautions to account for them.

“The forecasting assumptions that we make don’t assume strong growth; it assumes modest growth. We always err on the conservative side,” Johnson said.

However, if the economy—and the correlated property values—significantly weakens or contracts during this period, the college may need to tighten purse strings.

“If the college were to lose a significant portion of their property tax assessed value, as with any institution that runs on property tax revenue, it would have to make some tough decisions,” Johnson said. “But both the administration and the board of trustees are very adamant about [ensuring] affordability for our students.”